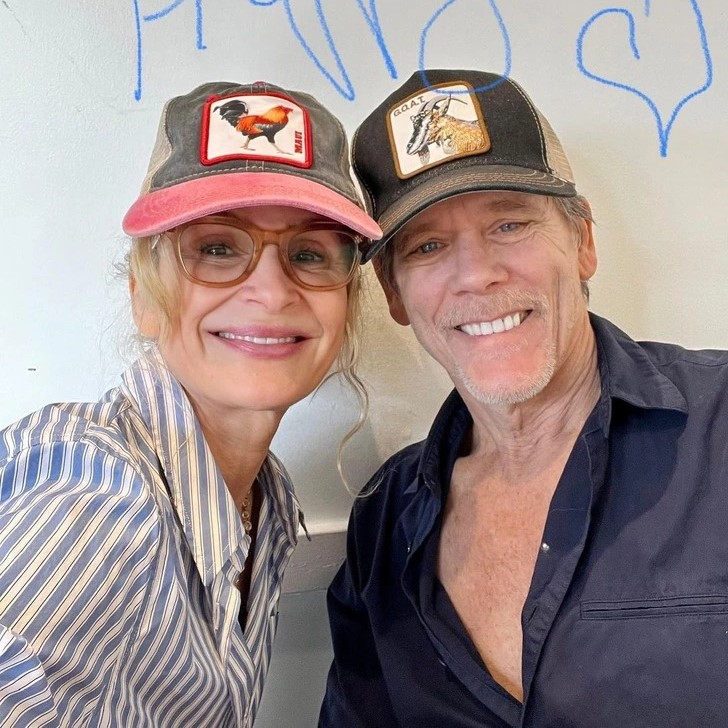

When Bernie Madoff’s $65 billion Ponzi scheme collapsed in December 2008, thousands of investors were left devastated — including Hollywood couple Kevin Bacon and Kyra Sedgwick.

Reports estimate the actors lost $30 million, representing most of their wealth at the time.

Like many others, they were drawn in by the promise of consistent returns, only to see the illusion vanish when Madoff was arrested and convicted of fraud and money laundering.

Turning to Real Estate for Stability

After the financial blow, Bacon and Sedgwick strategically turned to real estate as a safer and more reliable means of rebuilding.

Unlike volatile stock markets, real estate provided tangible assets, rental income, tax benefits, and long-term appreciation potential.

Advisors also likely highlighted its resilience in downturns, making property ownership a sound choice for their recovery.

A Diversified Property Portfolio

The couple’s holdings are spread across New York, Los Angeles, and Connecticut, giving them a diversified footprint across key U.S. markets.

Their 40-acre farm estate in Sharon, Connecticut, acquired in 1983, has proven to be a cornerstone of their wealth.

Connecticut’s real estate market has surged by 64% between 2020 and 2025, significantly boosting the value of their property.

While Los Angeles has seen short-term dips, New York has enjoyed nearly a 5% annual increase, making their multi-market approach both resilient and profitable.

Lessons in Risk and Recovery

Bacon and Sedgwick’s comeback highlights several lessons for investors.

They avoided high leverage, focused on properties with proven income potential, and embraced diversification to reduce risk.

By using tools like 1031 exchanges to defer capital gains taxes, they reinvested profits directly into new opportunities.

Their patience during market fluctuations — holding properties through cycles rather than panic-selling — allowed appreciation and rental income to compound steadily over time.

A Model for Wealth Rebuilding

What began as a devastating loss has become a masterclass in financial resilience.

Bacon and Sedgwick treated real estate investment like a business venture, leaning on research, professional advisors, and joint decision-making as a couple.

Their calculated pivot has not only stabilized their finances but positioned them to recover the $30 million lost to Madoff’s scheme.

Their journey shows that even catastrophic setbacks can be overcome through discipline, diversification, and long-term vision.

For inquiries regarding copyright, credit, or removal, please contact us using our contact form.

If you enjoyed this sneak peek into luxury homes, “SHARE” and help us spread the inspiration.